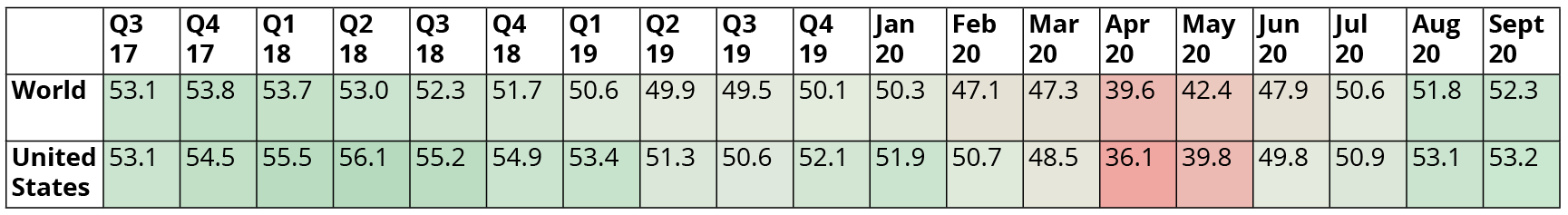

U.S. manufacturing is poised to grow

Following steep declines due to pandemic-related shutdowns, U.S. manufacturing, as measured by IHS Markit’s Purchasing Managers' Index (“PMI”), which is an index of economic trends in the manufacturing and service sectors, has recovered and moved materially higher in the summer months of 2020. This positive trend is expected to continue with non-essential manufacturing restarting in all states, and also as large auto manufacturers and aerospace manufacturers begin to ramp up production.1

IHS Markit's Manufacturing PMI Score

Source: IHS Markit as of 9/30/2020, Institute for Supply Management, Emles Advisors LLC

We expect that manufacturing businesses domiciled in the U.S., along with those that continue to employ a large share of the U.S. workforce, are poised for growth. While accelerated by the COVID-19 pandemic, we believe there are 5 key drivers of this long-term, structural shift to U.S. domestic manufacturing.

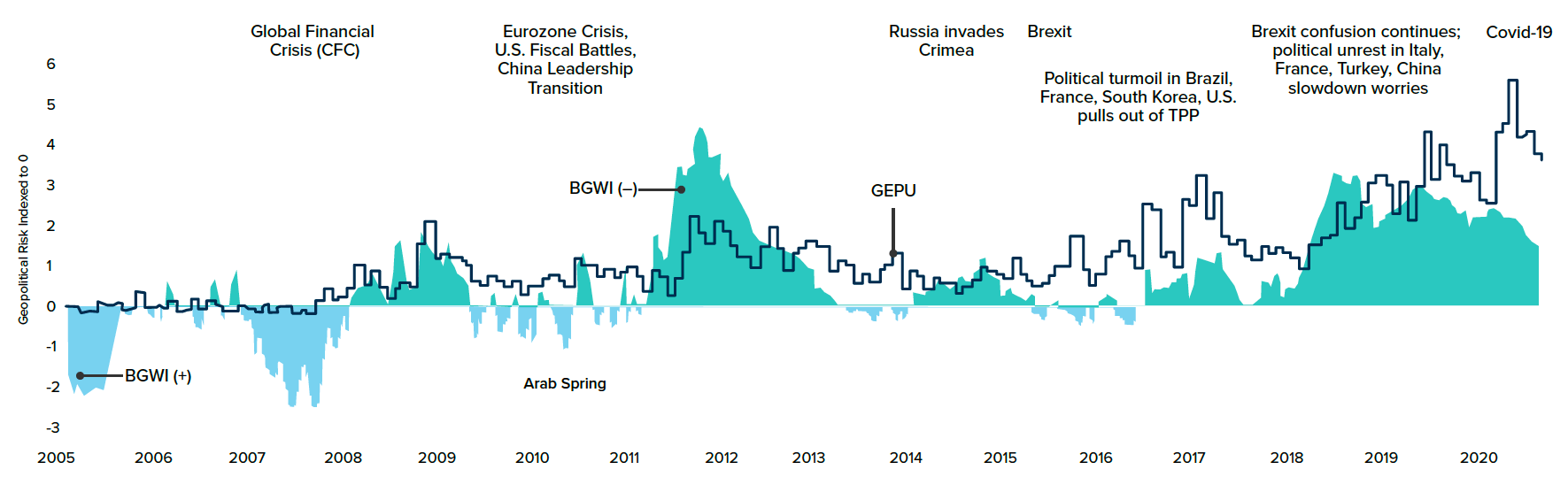

1. Geopolitical unrest

Industry indices, such as BGRI and GEPU, measure the risk of geopolitical shocks over time by tracking news articles, tweets, and analyst reports. As depicted below, both indices show elevated levels over the past few years, indicating increased risk for geopolitical unrest. These raised levels are being driven by political tensions and conflicts globally; ongoing trade wars resulting in significant tariffs on both Chinese and U.S. goods, escalating tensions around the China Sea conflict and uncertainty around Brexit are increasingly highlighting the need for more domestic supply lines. Additionally, the upcoming U.S. election adds an extra dimension of uncertainty. As geopolitical unrest continues to persist, and potentially further exacerbated by the ongoing Covid-19 pandemic, we believe companies will continue to bring production back to the U.S.

Geopolitical Risk Index Performance Over Time (BGRI vs. GEPU)

Blackrock, "Measuring Economic Policy Uncertainty" by Scott R. Baker, Nicholas Bloom and Steven J. Davis, as updated at www.policyuncertainty.com. Monthly data normalized to 100 from 1985 to 2009 and indexed to 0 at 1/7/2005. Blackrock data as of 10/2/2020. GEPU as of 9/30/2020.

2. Bipartisan support

As of August 2020, $262 billion or ~14% of overall imports into the U.S. came from China.2 While the U.S. is divided on many fronts, both Republications and Democrats are discussing and crafting bills to decrease reliance on Chinese-made products and to mitigate supply chain disruptions for essential industries. We are also seeing a 2020 presidential election that is increasingly focused on Made in America policies. Democratic nominee, Joe Biden, proposed a $700 billion “Buy American” campaign dedicated to purchasing U.S.-based goods and investing in research and development.3 On the other side of the aisle, incumbent Republican nominee, President Trump, continues to take an “America First” approach to foreign policy. Preserving corporate ownership and intellectual property within the U.S. has increasingly become a well-acknowledged agenda. While specific policies from each side may differ, Emles expects that U.S.-centric manufacturing will benefit regardless of outcome of the presidential election, albeit at varying degrees.

3. Necessity for domestic production propelled by COVID-19

Supply chain disruptions are expected to continue, especially in jurisdictions hardest hit by the pandemic and with companies who have smaller footprints and limited optionality. In fact, the International Transport Forum anticipates that global freight transport may decrease by up to 36% by the end of 20204, as travel restrictions related to COVID-19 limit the transportation and distribution of goods. In tandem, the historical focus to reduce costs and make supply chains lean have resulted in highly efficient networks for sourcing, manufacturing, transporting products into the U.S. As a result, the cost/benefit analysis of global supply chains versus domestic supply chains continues to evolve as risks continue to emerge.

In addition to interferences in supply chains, government funded financial assistance is expected to fuel domestic manufacturing. The historic $2 trillion stimulus package (CARES Act), demonstrates the U.S. Federal Reserve’s (“Fed”) and Treasury’s willingness to protect the U.S. economy during the pandemic, and continues to visit providing additional support. The stimulus package provided financial assistance to certain manufacturers, particularly those focused on the development and production of medical equipment, including:

- $60 million to the U.S. Department of Commerce for small and medium sized manufacturers supporting the manufacturing of medical equipment and supplies.

- $1 billion to allow the Department of Defense to invest in manufacturing capabilities key to increasing production of medical equipment for healthcare workers.

- $80 million to the Food and Drug Administration for the creation of medical countermeasures and vaccines.5

4. Drive towards lower carbon footprints

Manufacturing and logistics are responsible for a large percentage of greenhouse gas emissions – the International Transport Forum estimates that 30% of all transport-related, and more than 7% of global CO2 emissions, are from trade-related international freight. Over the long-term, it’s expected that by 2050, trade-related freight transport emissions will increase by a factor of 3.9x.6 To date, international trade has favored efficiency over sustainability – resulting in increased emissions and carbon footprint.

However, investors and consumers are increasingly demanding sustainably sourced products, or goods that are manufactured and delivered through sustainable processes and companies. Tracible, green supply chains are gaining significant traction. This shift in preferences could potentially benefit companies with shorter supply chains, or supply chains that are based domestically.

5. Innovation

In order to remain competitive, many companies have felt the pressure to reduce labor costs. This, combined with lower wages in emerging markets, was a driving factor of globalization in the past. However, automated manufacturing powered by technology and artificial intelligence is opening the door to new, more efficient processes that require less human capital. With U.S. dominating in patents and new technology adoption, advanced manufacturing technologies can help improve economies of localized production in U.S., bringing more companies home and fueling further job creation in the U.S.

Seek to capitalize on the shift towards domestic manufacturing with AMER

We believe the broader trend of deglobalization will continue to grow, and America-first policies will increasingly bring U.S. manufacturing back to prominence. Companies with a U.S. manufacturing footprint may potentially stand to benefit from increased production domestically, in turn providing investors with an opportunity to enhance their return potential. The Emles Made in America ETF (AMER) invests in a portfolio of companies that manufacture and generate substantial revenue in the U.S. AMER may act as a core complement to diversify equity positions and provide growth potential.

Tags: ETF, Growth, Manufacturing