How is Bitcoin difference from other digital assets?

Bitcoin is unique because it was the first operational digital currency. It remains the largest in the digital asset industry. Bitcoin has historically commanded at least 60% of the total digital asset market cap and remains the industry benchmark to this day.1 As the industry has grown, hundreds of other digital assets have been launched. Non-Bitcoin digital assets vary in structure, goals and use cases.

What is a digital asset?

Definitions of digital assets are not uniform across the industry. For purposes of this article, we define “digital assets” as an electronic record in which the owner has a right or interest. Unlike a physical asset, digital assets do not exist in physical form. For example, Bitcoin is a digital asset because it is an electronic record that is created and stored exclusively on the Bitcoin blockchain.2 By contrast, ownership of a “digitized asset” is also stored in an electronic record but represents a security or a physical asset.3 One example of a digitized asset is an electronic record of ownership of real estate stored on a digital ledger.

Digital and digitized assets that are recorded on a blockchain are commonly referred to as “blockchain tokens.”4 A blockchain token is “a digital token created on a blockchain as part of a decentralized software protocol.”5

What are the largest digital assets?

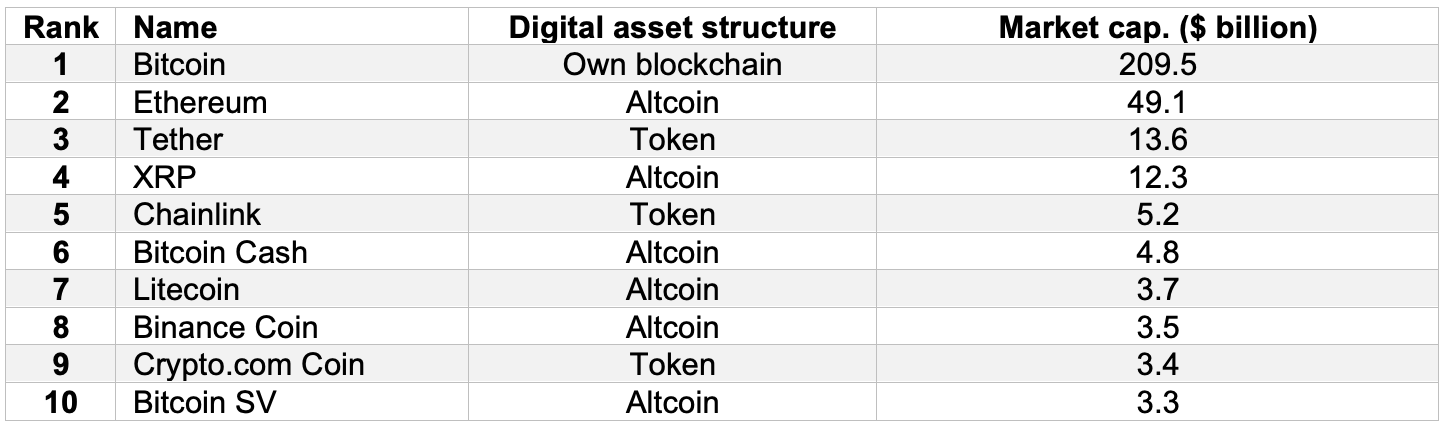

Bitcoin and Ethereum are the largest and most prevalent digital assets. Other coins such as XRP, Tether, Bitcoin Cash, and Litecoin are also well-known. We present a list of the 10 largest coins below:

Figures as of August 31, 2020 Source: Coinmarketcap.com, Cryptoslate.com, Emles Advisors LLC

What are the different types of digital assets?

While there are thousands of Non-Bitcoin digital assets that aim to provide various services within the digital asset community, there are just two types of assets:

- Coins (a.k.a. “cryptocurrencies”): A digital coin is an asset that is native to its own blockchain. For example, Bitcoin is based on the Bitcoin blockchain, the oldest blockchain in existence. Bitcoin is a coin, while altcoins (short for “alternative to Bitcoin” coins) are any non-Bitcoin digital assets that are hosted on their own independent blockchains. Ether is based on the Ethereum blockchain, and Litecoin is based on its own Litecoin blockchain: Ether and Litecoin are therefore considered altcoins. Most of the bigger digital assets fall into this category. Coins are intended to serve as digital cash and are likely to have features to those of traditional money.

- Tokens: Unlike Bitcoin and altcoins, tokens do not operate independently and are built on top of a network of a coin’s blockchain. Tokens allow businesses to create digital assets that have the ability to 1) incentivize and provide utility to customers, 2) represent shares in companies or illiquid assets such as real estate or art, or 3) serve as means of payment,6 without the responsibility of operating a blockchain.

While Bitcoin is by far the vanguard among all coins, Ethereum commands similar status across the tokens. As of April 2020, 87% of all operational tokens, also known as ERC tokens, had been issued on the Ethereum blockchain.7

Conclusion

As interest in digital assets continues to grow and new altcoins and tokens enter the market, investors should ensure they understand the differences between various types of digital currencies. Additionally, they should take into account the established nature of Bitcoin vs. other digital currencies when assessing the risks and roles that such assets may play in a portfolio.

Tags: Digital Currency, Diversification