A new wave of investors is crashing into the market for the first time. If you’re like many beginners, you see value in investing strategically. The bad news? Financial advice tends to be full of confusing jargon or windy explanations that make it hard to know where to start investing.

We’re here to help. Read on for a simple breakdown of what you need to know as a new investor, along with seven investment strategies for beginners.

Buy-and-hold ETF investing is one of the best investment strategies for beginners.

Before diving into more specific investing tactics, it’s important to highlight this simple investment strategy for beginners: buy-and-hold ETF investing. With this strategy, you buy an exchange-traded fund (ETF) and keep it for the long run. It can be a profitable strategy if you invest in companies that shrug off short-term market headwinds and climb to long-term profit.

Are you wondering why ETF buy-and-hold strategies are a great investment strategy for beginners? For one, you don't have to spend hours monitoring market news, placing trades, and timing markets. At the same time, this strategy reduces the risk of making poor financial decisions based on your emotions. If you build a diversified portfolio using high-value ETFs, it’s possible to comfortably buy and hold through market swings and bring in a steady stream of profit.

Wondering why ETFs are such a wise go-to target for beginners? ETFs fit soundly in this buy-and-hold strategy because they spread out risk and tend to be anchored by reliable companies. Here are a few advantages of ETFs:

- They can help diversify your portfolio.

- They may be less susceptible to sharp market swings.

- They generally tend to be low-cost and tax-efficient.

Which 4 investment strategies can help you determine what to buy?

So, you’ve decided that you want to use an ETF buy-and-hold strategy to grow your early investments. You still need to answer an important question: “What should you buy?” Here are the best investment strategies to consider as you decide where to put your money:

1. Broad Market Investing

With broad market investing, you target funds that follow a common index. This approach will give you broad exposure through indexes that are spread out across the market. For instance, you may decide to invest in SPY, which follows the S&P 500.

So long as you follow a buy-and-hold approach within this strategy, you can expect your returns to mimic the broad market. Before you invest, ensure you understand how each index is constructed and how heavily different individual securities are weighted within the fund.

2. Sector Trading

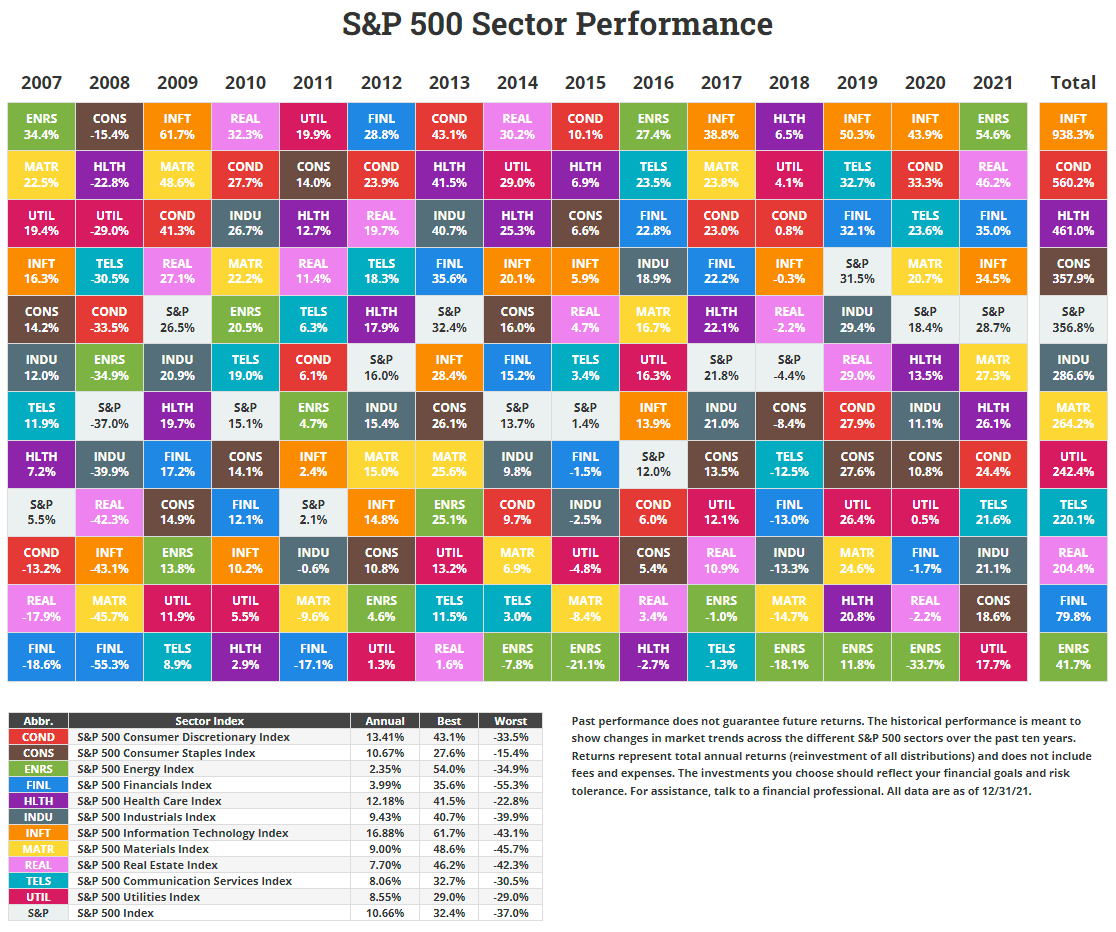

With a sector trading strategy, you invest in companies that fall within a single area of the market. Sector traders will target a specific part of the economy they believe will rise or fall in the future. This strategy can be profitable if you successfully identify how specific sectors in the market will move. However, it can be risky if the entire sector falls to pieces.

Source: novelinvestor.com

Source: novelinvestor.com

As you can see in the above illustration, sector performance can vary widely from year to year. The chart displays how the 11 S&P 500 sectors performed each calendar year compared to each other and the index. For example, you can see how the financial and real estate indexes were among the worst-performing sectors leading up to and during the Great Recession. Understanding economic trends and market fluctuations are key to succeeding with this type of strategy.

3. Active Funds

Active funds are ETFs that you can buy and hold while your fund manager manages your holdings. Essentially, this is an approach in which you seek more aggressive returns, but leave it to the experts to make frequent trades. Although this investment strategy may include more buying and selling than a passive investing strategy, you may be exposed to less overall market risk by trusting your money with a professional who actively manages an ETF.

On the whole, it is a good idea for beginners to spread their investments across a blend of all three investment sources: broad markets, sector trading, and active funds.

What are the 4 best investment strategies to evaluate stock market holdings?

Before buying an ETF, examine which stocks and what percentage of each holding make up that ETF. When it comes time to evaluate these ETF holdings, beginners need a second strategy. Here are a few investing strategies to use as you dig into each fund’s holdings:

1. Value Stocks

With value investing, you buy stocks worth more than they are currently trading for on the market. With this strategy, you recognize that the market will swing on a short-term basis, so you invest in stocks that have strong fundamentals and high long-term value.

Seasoned investors and successful beginners alike will use value investing to underpin their moves within the stock market. In fact, value investing is lauded by some of the most successful investors in history, including Warren Buffet and Charlie Munger.

2. Growth Stocks

Growth stock investing is an investing strategy in which you try to pick out companies that are just starting or are vastly undervalued. The idea here is to buy stocks that will balloon in the future. This strategy can provide hefty returns if you pick a position that takes off. However, these stocks can be risky—especially in a shaky economic market— if the stocks are part of a temporary trend or overvalued.

3. Momentum Stocks

Momentum stocks are holdings that are experiencing an uptrend. To earn a profit, you will want to pick momentum stocks that you believe will keep surging upward after you buy them. Of course, it isn’t always a guarantee that momentum stocks will keep climbing once you pull them into your portfolio, but holding on to the stocks that do can increase your long-term returns.

4. Quality Stocks

Quality stocks are holdings that display the strongest fundamentals in the market. These stocks tend to include best-in-class companies. Investing in quality stocks means you are buying an equity share in companies that have a proven record of high returns. Although quality stocks may be priced higher than other stocks, they also carry less risk because they tend to be backed by financially sturdy companies.

The best investment strategies are fueled by education.

Regardless of what strategy or strategies you ultimately choose, the best investments are built on knowledge. As a beginner, the best thing you can do is examine your investment options and pick the best tactic for your situation.

Want investing tips, tricks, and insights delivered to your inbox as soon as they break? Subscribe to the Emles Advisors blog to get the expert advice you need to make smart investing decisions.

Tags: Diversification, ETF, Investing